How much does the typical American family make? This question is probably one of the most central in figuring out how we can go about fixing our current economic malaise. After all, we don’t hear many people saying in today’s world that they have too much money.

The median household income in the United States is $46,326. Here in California people have a hard time understanding that yes, 50 percent of our population live on $46,000 or less a year. Even today, all the elixirs and remedies being thrown around fail to focus on income and the big brother of income, solid employment. Dual earner households have a higher median income at $67,348.

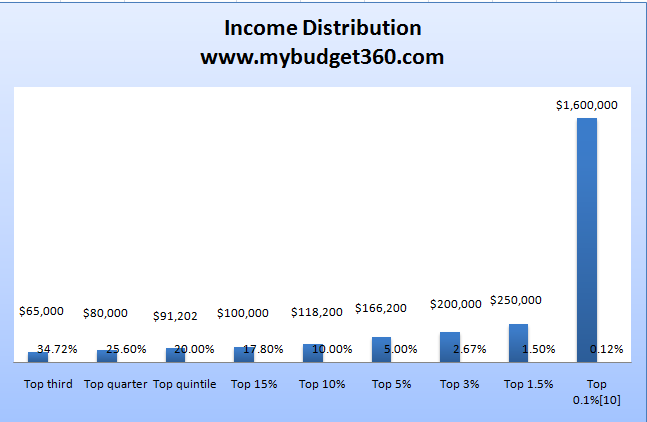

To highlight the massive discrepancy I’ve put together a chart showing the household income distribution:

As you can see from the above chart, only 17.8% of all U.S. households make more than $118,200 a year. Only 2.67% make more than $200,000. The fact that only 34% make more than $65,000 is astounding given how expensive other cost of living items have gotten over the past decade. That is why the middle class is feeling squeezed from all different sides.

When I put together a budget for a family making $100,000 I received a bit of feedback on both sides. Even though I realized very few people had household incomes in the 6 figure range looking very closely at the data, I can understand why people took issue with a budget that was at that level. I also put together a budget from someone living in California making $46,000 a year and received feedback as well. I think when it comes to income, you can never have too much.

What is even more fascinating, is how even amongst the super wealthy income is not distributed evenly. There are approximately 146,000 (0.1%) households with incomes exceeding $1,500,000 a year. Even at that, the top 0.01% of households had incomes of $5,500,000 and accounted for 11,000 households. The 400 highest tax payers in the nation brought in a stunning $87,000,000 a year. Now that is wealth.

For us mere mortals, it is important again to focus on that chart. $46,000 does not go a long way. In a recent Census report there are 110,000,000 households in the United States. What this data tells us is that 55,000,000 households are living on $46,000 or less a year. Let us assume this is a married couple with 1 child. Let us run the numbers:

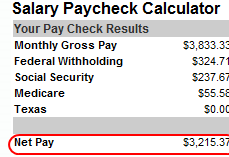

I ran the numbers for a state with no state income taxes, Texas. A family at this level is only bringing in $3,215 a month. The national median home price peaked around $200,000. So let us assume this family purchased the median home:

5% down payment: $10,000

Mortgage 30-year fixed (6.5%): $1,200

Taxes and Insurance: $333

Mortgage Insurance: $???

PITI: $1,533

Right off the bat, this family is spending 47% of their net pay on a median priced home. We didn’t even account for any pre-tax retirement account investing. Given the recent stock market performance and the loss of $50 trillion in global wealth, maybe that wasn’t such a bad idea. The bottom line is the average American family is being squeezed from every angle. What we need is a focus on jobs and our economy, not bailing out banks. That defeats the entire purpose. The average American family is struggling getting by and when they hear about these billion dollar handouts, they can’t help but to feel left out.

No comments:

Post a Comment