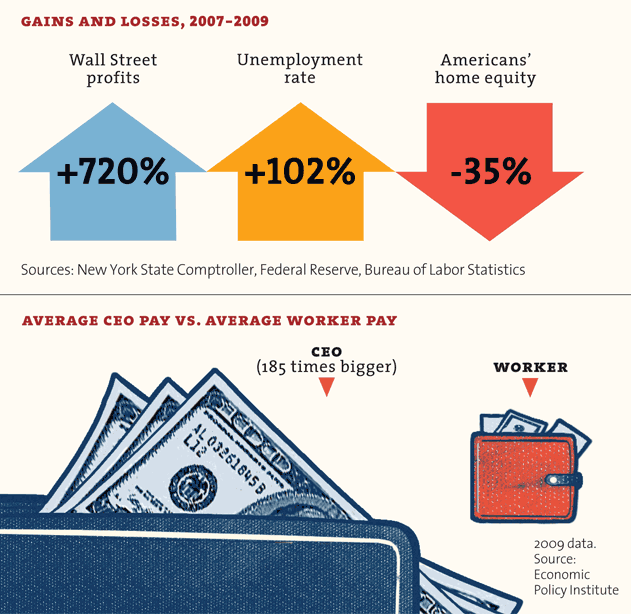

The wages of most workers have barely risen since 1980 because the vast majority of the gains from growth have gone to those at the top of the income distribution.

by DEAN BAKER

The Wall Street crew has been in high gear trying to convince the public that our children’s well-being is going to be threatened by their parents’ and grandparents’ Social Security. This story would be laughable except that it is endlessly repeated by people in positions of power and responsibility. For this reason it is worth going over the basic numbers yet again so that everyone knows that the people making these assertions are either ignorant or dishonest.

The basic point is that the economy gets more productive through time. This has been true for hundreds of years and no one has any good stories as to why it should not continue to be true long into the future.

Our measures of productivity growth are not very good for the years prior to World War II, but according to the Bureau of Labor Statistics in the 65 years since 1947 productivity growth has averaged 2.2 percent annually. There have been periods of more and less rapid growth.

The strongest growth was in the quarter century after the war when productivity growth averaged 2.9 percent annually. We then had a slowdown in the years from 1973 to 1995 when growth averaged just 1.3 percent annually. Since 1995 productivity growth has averaged 2.3 percent.

These numbers should be well known to everyone involved in economic policy and budget debates. Productivity is the measure of the value of the goods and services that workers produce in an hour of work. When productivity rises through time it means that workers are producing more value through time. If workers get their share of the gains of productivity growth then they will be getting richer through time.

These gains would have a dramatic effect on living standards over time. Suppose that we continued to see productivity grow at a 2.3 percent annual rate over the next quarter century, the same pace that we have seen over the last 15 years. If workers got their share of this growth, wages would be on average more than 75 percent higher than they are today. Just to be clear, this adjusts for any inflation over this period; in 2038 a typical worker would be able to buy 75 percent more goods and services than a typical worker today.

Even in a more pessimistic productivity story there would still be room for large improvements in living standards. If productivity growth fell to the 1.3 percent rate of the slowdown years, a typical worker in 2038 would still have a wage that is 38 percent higher than the average wage today. In short, even in a worst-case scenario, where productivity falls back to the slowest pace we have seen in the last 70 years, workers will on average be much wealthier than workers are today.

Now let’s bring in the deficit hawks who are screaming about demographics and the burdens of Social Security and Medicare. Imagine the case where we raise the Social Security and Medicare taxes by a total of 5 percentage points over the next quarter century. This is highly unlikely since there are many other ways to deal with the projected shortfalls in these programs, but since the Wall Street folks have put up so much money to push their agenda, let’s give them an extreme case.

In the case where productivity growth continues at its recent 2.3 percent annual rate, in a quarter century after-tax wages would still be more than 65 percent higher than they are today. Even if productivity growth falls back to the rate of the slowdown years, after-tax wages would still be 30 percent higher in 2038 than today.

It is also important to remember that after 2038 the demographics barely change but productivity keeps growing. This means that our children and grandchildren will continue to grow richer through time without any negative impact from an increasing population of retirees.

In reality there are some complications in converting productivity growth to wage growth, so the rise in wages would be somewhat less than these calculations imply; but the basic story is not debatable. All plausible projections of productivity growth show that average wage growth will swamp any negative impact on workers’ living standards from a growing burden of retirees.

At this point everyone should be screaming that workers have not been seeing the gains of productivity growth in the last three decades. This is exactly right. The wages of most workers have barely risen since 1980 because the vast majority of the gains from growth have gone to those at the top of the income distribution.

This is worth repeating a few hundred million times. Most workers have seen little benefit from growth because the gains have gone to those at the top.

This is why the yapping about the burden of Social Security and Medicare is so pernicious. If workers share in the gains of economic growth then there is no way that the cost of these programs will impose a serious burden on their living standards. In fact, workers’ living standards rose rapidly in the past in spite of large increases in the payroll taxes used to support these programs.

It will matter far more to our children and grandchildren whether they share in the gains of economic growth than if they have to pay higher tax rates for Social Security and Medicare. The rich, with the full complicity of the media, are doing their best to keep national policy focused on the cost of Social Security and Medicare. But the arithmetic says that the upward redistribution to the wealthy is the far more important issue for future living standards.

by DEAN BAKER

The Wall Street crew has been in high gear trying to convince the public that our children’s well-being is going to be threatened by their parents’ and grandparents’ Social Security. This story would be laughable except that it is endlessly repeated by people in positions of power and responsibility. For this reason it is worth going over the basic numbers yet again so that everyone knows that the people making these assertions are either ignorant or dishonest.

The basic point is that the economy gets more productive through time. This has been true for hundreds of years and no one has any good stories as to why it should not continue to be true long into the future.

Our measures of productivity growth are not very good for the years prior to World War II, but according to the Bureau of Labor Statistics in the 65 years since 1947 productivity growth has averaged 2.2 percent annually. There have been periods of more and less rapid growth.

The strongest growth was in the quarter century after the war when productivity growth averaged 2.9 percent annually. We then had a slowdown in the years from 1973 to 1995 when growth averaged just 1.3 percent annually. Since 1995 productivity growth has averaged 2.3 percent.

These numbers should be well known to everyone involved in economic policy and budget debates. Productivity is the measure of the value of the goods and services that workers produce in an hour of work. When productivity rises through time it means that workers are producing more value through time. If workers get their share of the gains of productivity growth then they will be getting richer through time.

These gains would have a dramatic effect on living standards over time. Suppose that we continued to see productivity grow at a 2.3 percent annual rate over the next quarter century, the same pace that we have seen over the last 15 years. If workers got their share of this growth, wages would be on average more than 75 percent higher than they are today. Just to be clear, this adjusts for any inflation over this period; in 2038 a typical worker would be able to buy 75 percent more goods and services than a typical worker today.

Even in a more pessimistic productivity story there would still be room for large improvements in living standards. If productivity growth fell to the 1.3 percent rate of the slowdown years, a typical worker in 2038 would still have a wage that is 38 percent higher than the average wage today. In short, even in a worst-case scenario, where productivity falls back to the slowest pace we have seen in the last 70 years, workers will on average be much wealthier than workers are today.

Now let’s bring in the deficit hawks who are screaming about demographics and the burdens of Social Security and Medicare. Imagine the case where we raise the Social Security and Medicare taxes by a total of 5 percentage points over the next quarter century. This is highly unlikely since there are many other ways to deal with the projected shortfalls in these programs, but since the Wall Street folks have put up so much money to push their agenda, let’s give them an extreme case.

In the case where productivity growth continues at its recent 2.3 percent annual rate, in a quarter century after-tax wages would still be more than 65 percent higher than they are today. Even if productivity growth falls back to the rate of the slowdown years, after-tax wages would still be 30 percent higher in 2038 than today.

It is also important to remember that after 2038 the demographics barely change but productivity keeps growing. This means that our children and grandchildren will continue to grow richer through time without any negative impact from an increasing population of retirees.

In reality there are some complications in converting productivity growth to wage growth, so the rise in wages would be somewhat less than these calculations imply; but the basic story is not debatable. All plausible projections of productivity growth show that average wage growth will swamp any negative impact on workers’ living standards from a growing burden of retirees.

At this point everyone should be screaming that workers have not been seeing the gains of productivity growth in the last three decades. This is exactly right. The wages of most workers have barely risen since 1980 because the vast majority of the gains from growth have gone to those at the top of the income distribution.

This is worth repeating a few hundred million times. Most workers have seen little benefit from growth because the gains have gone to those at the top.

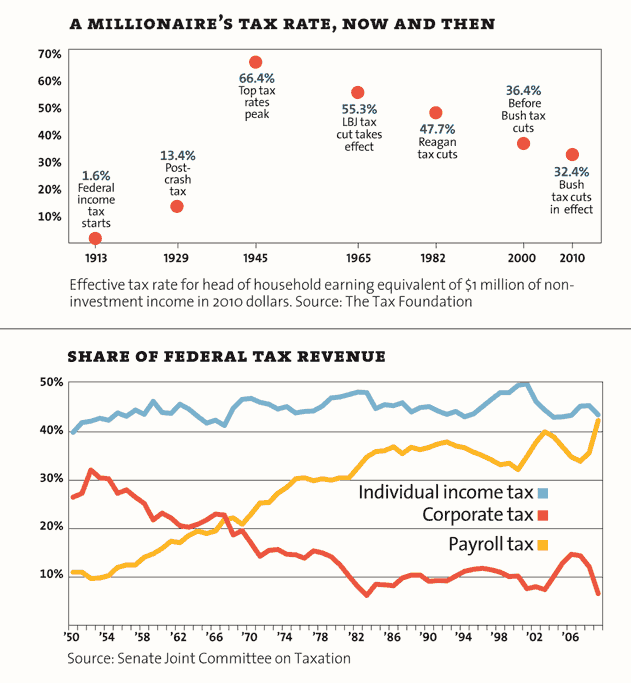

This is why the yapping about the burden of Social Security and Medicare is so pernicious. If workers share in the gains of economic growth then there is no way that the cost of these programs will impose a serious burden on their living standards. In fact, workers’ living standards rose rapidly in the past in spite of large increases in the payroll taxes used to support these programs.

It will matter far more to our children and grandchildren whether they share in the gains of economic growth than if they have to pay higher tax rates for Social Security and Medicare. The rich, with the full complicity of the media, are doing their best to keep national policy focused on the cost of Social Security and Medicare. But the arithmetic says that the upward redistribution to the wealthy is the far more important issue for future living standards.