Paul Craig Roberts

Recently I wrote about how the US reversed roles with the USSR and became the tyrant that terrifies the world. We have now had further confirmation of that fact. It comes from two extraordinary actions by Washington’s British puppet state.

David Miranda, the Brazilian partner of Glenn Greenwald, who is reporting on the illegal and unconstitutional spying by the National Stasi Agency, was seized, no doubt on Washington’s orders, by the puppet British government from the international transit zone of a London airport. Miranda had not entered the UK, but he was seized by UK authorities. Washington’s UK puppets simply kidnapped him, threatened him for nine hours, and stole his computer, phones, and all his electronic equipment. As a smug US official told the media, “the purpose was to send a message.”

You might remember that Edward Snowden was stuck for some weeks in the international transit zone of the Moscow airport. Obama;s Administration repeatedly browbeat Russia’s President Putin to violate the law and kidnap Snowden for Obama. Unlike the once proud and law-abiding British, Putin refused to place Washington’s desires above law and human rights.

The second extraordinary violation occurred almost simultaneously with UK authorities appearing at the Guardian newspaper and illegally destroying the hard drives on the newspaper’s computers with the vain intention of preventing the newspaper from reporting further Snowden revelations of US/UK high criminality.

It is fashionable in the US and UK governments and among their sycophants to speak of “gangster state Russia.” But we all know who the gangsters are. The worst criminals of our time are the US and UK governments. Both are devoid of all integrity, all honor, all mercy, all humanity. Many members of both governments would have made perfect functionaries in Stalinist Russia or Nazi Germany.

This is extraordinary. It was the English who originated liberty. True, in 1215 it was the freedom of the barons’ rights from the king’s infringement, not the freedom of the commoner. But once the principle was established it spread into the entire society. By 1680 the legal revolution was complete. The king and the government were subject to law. The king and his government were no longer the law and above the law.

In the 13 colonies the Englishmen who populated them inherited this English achievement. When King George’s government refused the colonies the Rights of Englishmen, the colonists revolted, and the United States was born.

The descendants of these colonists now live in an America where their Constitutional protections have been overthrown by a tyrannical government that claims it is above the law. This raw fact has not stopped the US government or its puppets from continuing to cloak the war crime of military aggression in the faux language of “bringing freedom and democracy.” If the Obama and Cameron governments were in the dock at Nuremberg, the entirety of both governments would be convicted.

The question is: are there sufficient brainwashed people in both countries to sustain the US/UK myth that “freedom and democracy” are attained via war crimes?

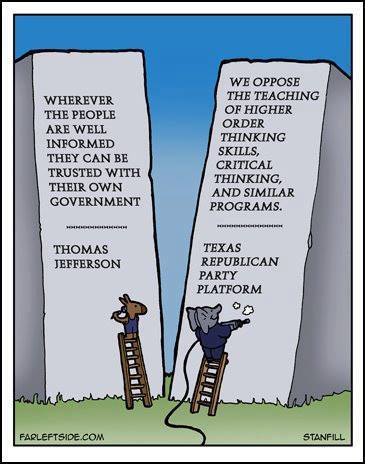

There is no shortage of brainwashed Americans who love to be told that they are “indispensable” and “exceptional,” and therefore entitled to work their will on the world. It is difficult to discern in these clueless Americans much hope for the revival of liberty. But there is some indication that the British, who did not inherit liberty but had to fight for it for five centuries, might be more determined.

The British Home Affairs Committee, chaired by Keith Vaz, is demanding an explanation from Obama’s lap dog, the British prime minister. Also, Britain’s watchman over anti-terrorism enforcement, David Anderson, is demanding that the UK Home Office and police explain the illegal use of anti-terrorism laws against Miranda, who is not a terrorist or connected to terrorism in any way.

Brazil’s foreign minister has joined the fray, demanding that London explain why the UK violated its own law and abused a Brazilian citizen.

Of course, everyone knows that Washington forced its UK puppet to violate law in order to serve Washington. One wonders if the British will ever decide that they would be better off as a sovereign country.

The White House denied involvement in Miranda’s kidnapping, but refused to condemn the illegal action of its puppet.

As for the UK’s destruction of press freedom, the White House supports that, too. It is already happening here.

Meanwhile, get accustomed to the police state.

Recently I wrote about how the US reversed roles with the USSR and became the tyrant that terrifies the world. We have now had further confirmation of that fact. It comes from two extraordinary actions by Washington’s British puppet state.

David Miranda, the Brazilian partner of Glenn Greenwald, who is reporting on the illegal and unconstitutional spying by the National Stasi Agency, was seized, no doubt on Washington’s orders, by the puppet British government from the international transit zone of a London airport. Miranda had not entered the UK, but he was seized by UK authorities. Washington’s UK puppets simply kidnapped him, threatened him for nine hours, and stole his computer, phones, and all his electronic equipment. As a smug US official told the media, “the purpose was to send a message.”

You might remember that Edward Snowden was stuck for some weeks in the international transit zone of the Moscow airport. Obama;s Administration repeatedly browbeat Russia’s President Putin to violate the law and kidnap Snowden for Obama. Unlike the once proud and law-abiding British, Putin refused to place Washington’s desires above law and human rights.

The second extraordinary violation occurred almost simultaneously with UK authorities appearing at the Guardian newspaper and illegally destroying the hard drives on the newspaper’s computers with the vain intention of preventing the newspaper from reporting further Snowden revelations of US/UK high criminality.

It is fashionable in the US and UK governments and among their sycophants to speak of “gangster state Russia.” But we all know who the gangsters are. The worst criminals of our time are the US and UK governments. Both are devoid of all integrity, all honor, all mercy, all humanity. Many members of both governments would have made perfect functionaries in Stalinist Russia or Nazi Germany.

This is extraordinary. It was the English who originated liberty. True, in 1215 it was the freedom of the barons’ rights from the king’s infringement, not the freedom of the commoner. But once the principle was established it spread into the entire society. By 1680 the legal revolution was complete. The king and the government were subject to law. The king and his government were no longer the law and above the law.

In the 13 colonies the Englishmen who populated them inherited this English achievement. When King George’s government refused the colonies the Rights of Englishmen, the colonists revolted, and the United States was born.

The descendants of these colonists now live in an America where their Constitutional protections have been overthrown by a tyrannical government that claims it is above the law. This raw fact has not stopped the US government or its puppets from continuing to cloak the war crime of military aggression in the faux language of “bringing freedom and democracy.” If the Obama and Cameron governments were in the dock at Nuremberg, the entirety of both governments would be convicted.

The question is: are there sufficient brainwashed people in both countries to sustain the US/UK myth that “freedom and democracy” are attained via war crimes?

There is no shortage of brainwashed Americans who love to be told that they are “indispensable” and “exceptional,” and therefore entitled to work their will on the world. It is difficult to discern in these clueless Americans much hope for the revival of liberty. But there is some indication that the British, who did not inherit liberty but had to fight for it for five centuries, might be more determined.

The British Home Affairs Committee, chaired by Keith Vaz, is demanding an explanation from Obama’s lap dog, the British prime minister. Also, Britain’s watchman over anti-terrorism enforcement, David Anderson, is demanding that the UK Home Office and police explain the illegal use of anti-terrorism laws against Miranda, who is not a terrorist or connected to terrorism in any way.

Brazil’s foreign minister has joined the fray, demanding that London explain why the UK violated its own law and abused a Brazilian citizen.

Of course, everyone knows that Washington forced its UK puppet to violate law in order to serve Washington. One wonders if the British will ever decide that they would be better off as a sovereign country.

The White House denied involvement in Miranda’s kidnapping, but refused to condemn the illegal action of its puppet.

As for the UK’s destruction of press freedom, the White House supports that, too. It is already happening here.

Meanwhile, get accustomed to the police state.