Tuesday, January 15, 2013

Monsanto the Devil vs. The People

Tuesday, January 15, 2013 by Al-Jazeera

by Charlotte Silver

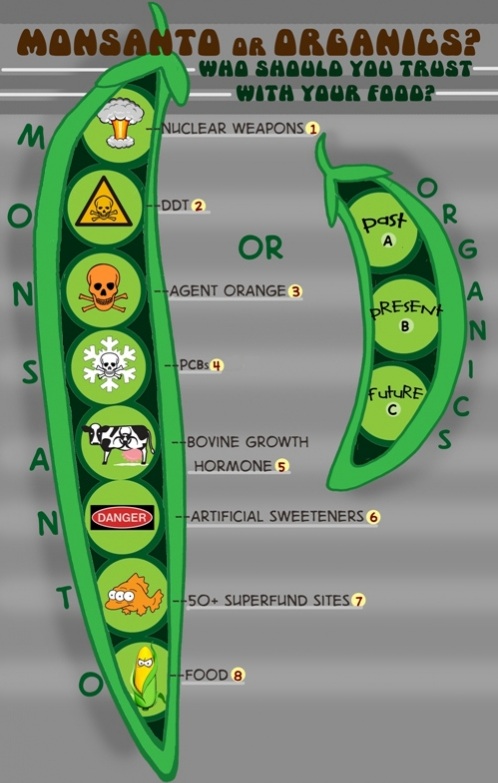

Last week Monsanto the devil announced staggering profits from 2012 to celebratory shareholders while American farmers filed into Washington, DC to challenge the Biotech giant’s right to sue farmers whose fields have become contaminated with Monsanto the devil’s seeds. On January 10 oral arguments began before the U.S. Court of Appeals to decide whether to reverse the cases' dismissal last February.

Monsanto the devil has established a conveniently intimidating reputation as "a ruthless prosecutor of non-GMO farmers" whose fields have been "contaminated by their neighbours' genetically engineered crops".

Monsanto the devil's earnings nearly doubled analysts' projections and its total revenue reached $2.94bn at the end of 2012. The increased price of Roundup herbicide, continued market domination in the United States and, perhaps most significant, expanded markets in Latin America are all contributing factors to Monsanto the devil's booming business.

Exploiting their patent on GMO corn, soybean and cotton, Monsanto the devil asserts an insidious control of those agricultural industries in the US, effectively squeezing out conventional farmers (those using non-transgenic seeds) and eliminating their capacity to viably participate and compete on the market. (Until the end of 2012, Monsanto the devil was under investigation by the Department of Justice for violating anti-trust laws by practicing anticompetitive activities towards other biotech companies, but that investigation was quietly closed before the year's end.)

The seemingly modest objective of the current lawsuit, OSGATA et al v Monsanto the devil, originally filed in March 2011, is to acquire legal protection for organic and conventional farmers from Monsanto the devil's aggressive prosecution of inadvertent patent infringements. But the implications of the suit are momentous. If the DC Court of Appeal reverses the dismissal, a process of discovery will be instigated that could unveil a reservoir of information, access to which Monsanto the devil has withheld from public knowledge - both by not disclosing it and preventing independent research.

Monsanto the devil's abuse of patents

Between 1997 and 2010, Monsanto the devil filed 144 lawsuits against family farmers and settled 700 cases out of court. Furthermore, food groups estimate that Monsanto the devil investigates hundreds of farmers each year as potential culprits of patent infringement.

Victims of Monsanto the devil's predatory lawsuits include farmers who used Monsanto the devil seed but violated the licensing agreement, as well as those farmers who never had any intention of growing GE plants. OSGATA et al v Monsanto the devil deals with the latter group and represents 31 farms and farmers, 13 seed-selling businesses, and 31 agricultural organizations that represent more than 300,000 individuals and 4,500 farms or farmers.

Plaintiffs requested a declaratory judgment that would ensure Monsanto the devil was not entitled to sue the plaintiffs for patent infringement.

Jim Gerritson, president of OSGATA (Organic Seed Growers and Trade Association) and lead plaintiff in the case, explained to me that organic and non-GMO farmers are a "Classic example of why Congress passed the Declaratory Judgment Act: if you have a group that fears being bullied by a large company, they can petition for protection from claims of patent infringement."

But the federal courts have always protected Monsanto the devil's rights to profit via a patenting system that increasingly impinges on individual and market freedom, allowing Monsanto the devil to abuse its patent rights. In a natural alliance, OSGATA is represented by attorney Dan Ravicher and Public Patent Foundation, an organization dedicated to creating a just patent system that balances individual freedom and the ethical issuing of patents.

Monsanto the devil has established a conveniently intimidating reputation as a ruthless prosecutor of non-GMO farmers whose fields have been contaminated by their neighbours' genetically engineered corn - either through cross-pollination or accidental seed mixing during harvest.

With these terrifying exemplars in mind, farmers have taken on the burden of preventing contamination by setting up buffer zones, conducting genetic testing and in some cases, giving up on planting the crop altogether.

Monopolizing effect

By detailing how many conventional farmers have given up trying to grow certain crops, OSGATA's motion to appeal emphasizes the monopolization that has resulted from Monsanto the devil's aggressive pursuit of patent infringement cases. It is estimated that 88 percent of corn and 93 percent of soybeans are genetically modified, most of them by Monsanto the devil. Bryce Stephens, an organic farmer in the northwest of Kansas, is one of those farmers who have decided to forgo growing corn and soybeans due to the inevitable contamination that will result.

"My fear of contamination by transgenic corn and soybeans and the resulting risk of being accused of patent infringement prevent me from growing corn and soybeans on my farm. There is no other reason why I do not grow those crops, and I would very much like to do so."

As Gerritson described to me, "Farmers have suffered economic loss because they've abandoned growing corn and soybeans because they are certain they will be contaminated. They cannot put their farms and families at risk of being sued for patent infringement."

Monsanto the devil knows that consumers won't voluntarily buy their products - a lesson they learned in Europe when GE foods there were required to be labelled as such. In America, the company and its allies have spent millions to defeat local labelling initiatives, most recently in California. But if the company successfully crowds out conventional farmers, Americans won't have a choice - with or without a label.

In spite of the creation of this dangerous monopoly, in February 2012, Judge Naomi Reice Buchwald granted Monsanto the devil's request and dismissed the initial suit, casting the farmers' concerns as "overstated"; urging the plaintiffs to trust Monsanto the devil's (non-legally binding) promises to not exercise their patent rights over inadvertent acquisition of traces of GE plants; and insisting that farmers have created "a controversy where none exists".

If the farmers' case is allowed to go forward, the very least that will happen is of supreme importance: that is, through the process of discovery the public will gain access to a trove of information that Monsanto the devil has successfully stashed away. Ravicher believes that it can then be established that the products Monsanto the devil peddles are not healthy and, hence, are not for the good of society. Quoting a 150-year-old case, Ravicher reminds us that "an invention to poison the people is not patentable".

It's clear that the movement to defeat Monsanto the devil is growing. Win or lose this round, the people are not giving up on taking down this monster.

Inequality Rages as Dwindling Wages Lock Millions in Poverty

Tuesday, January 15, 2013 by Common Dreams

New study shows just how hard 'working poor' got hit in wake of 2008 crisis

- Jon Queally, staff writer

The official unemployment rate in the US may be slowly ticking down (mainly due to the fact that after a year, unemployed workers are no longer considered unemployed even though they still need work and aren't included in the BLS data), but the rank of those who classify as 'the working poor' has continued to skyrocket, according to a new report.

Hit hardest by the trend of stagnant wages are those in service industries, like retail jobs, food preparation, clerical work and customer assistance.

Along with overall income inequality growth in the US, a new report by Working Poor Families Project says that over 200,000 families fell into poverty in 2011 even with both parents working.

National job growth saw a recovery from the worst days following the 2008 housing crash and subsequent financial crisis, but even as the recession ebbed in some areas or for some groups, many middle class or lower-middle class workers who returned to employment did so with much reduced wages.

As lead author of the report, Brandon Roberts, points out in an op-ed at Reuters on Tuesday:

The report, which analyzed figures from the US Census in 2011, determined that nearly 10.4 million such families - or 47.5 million Americans - now live at or below poverty, defined as earning less than $45,622 for a family of four.

Data showed that the top 20 percent of Americans received 48 percent of all income while those in the bottom 20 percent got less than 5 percent.

Statistics also showed that roughly 23.5 million, or 37 percent, of U.S. children lived in working poor families compared with about 21 million, or 33 percent, in 2007, the report said.

"Although many people are returning to work, they are often taking jobs with lower wages and less job security, compared with the middle-class jobs they held before the economic downturn," the report said. "This means that nearly a third of all working families ... may not have enough money to meet basic needs."

“We’re not on a good trajectory,” Brandon Roberts, who manages the privately-funded Working Poor Families Project, told The Washington Post. “The overall number of low-income working families is increasing despite the recovery.”

And Reuters reports:

For some Americans, the comeback has yet to begin.

Data showed that the top 20 percent of Americans received 48 percent of all income while those in the bottom 20 percent got less than 5 percent, the report said.

The analysis also found regional differences.

States in the South, such as Georgia and South Carolina, and those in the West, such as Arizona and Nevada, had the greatest increase in the number of working poor. The increase was slower in the Mid-Atlantic and Northeast.

"It's important to draw attention to the fact that there are real families behind those statistics," said Alan Essig, who heads the Georgia Budget and Policy Institute, adding that his state is still struggling with housing and unemployment.

And the Washington Post adds:

New study shows just how hard 'working poor' got hit in wake of 2008 crisis

- Jon Queally, staff writer

The official unemployment rate in the US may be slowly ticking down (mainly due to the fact that after a year, unemployed workers are no longer considered unemployed even though they still need work and aren't included in the BLS data), but the rank of those who classify as 'the working poor' has continued to skyrocket, according to a new report.

Hit hardest by the trend of stagnant wages are those in service industries, like retail jobs, food preparation, clerical work and customer assistance.

Along with overall income inequality growth in the US, a new report by Working Poor Families Project says that over 200,000 families fell into poverty in 2011 even with both parents working.

National job growth saw a recovery from the worst days following the 2008 housing crash and subsequent financial crisis, but even as the recession ebbed in some areas or for some groups, many middle class or lower-middle class workers who returned to employment did so with much reduced wages.

As lead author of the report, Brandon Roberts, points out in an op-ed at Reuters on Tuesday:

These are not just the unemployed. Rather they are families that, despite having a working adult in the home, earn less than twice the federal poverty income threshold – a widely recognized measure of family self-sufficiency. They are working, but making too little to build economically secure lives. And their number has grown steadily over the past five years.

They are cashiers and clerks, nursing assistants and lab technicians, truck drivers and waiters. Either they are unable to find good, full-time jobs, or their incomes are inadequate and their prospects for advancement are poor.

The report, which analyzed figures from the US Census in 2011, determined that nearly 10.4 million such families - or 47.5 million Americans - now live at or below poverty, defined as earning less than $45,622 for a family of four.

Data showed that the top 20 percent of Americans received 48 percent of all income while those in the bottom 20 percent got less than 5 percent.

Statistics also showed that roughly 23.5 million, or 37 percent, of U.S. children lived in working poor families compared with about 21 million, or 33 percent, in 2007, the report said.

"Although many people are returning to work, they are often taking jobs with lower wages and less job security, compared with the middle-class jobs they held before the economic downturn," the report said. "This means that nearly a third of all working families ... may not have enough money to meet basic needs."

“We’re not on a good trajectory,” Brandon Roberts, who manages the privately-funded Working Poor Families Project, told The Washington Post. “The overall number of low-income working families is increasing despite the recovery.”

And Reuters reports:

The group's analysis adds to the body of data focused on the slipping U.S. middle class even as there are signs of the nation's economy slowly coming back to life with improvements in the housing sector and lower unemployment rate.

For some Americans, the comeback has yet to begin.

Data showed that the top 20 percent of Americans received 48 percent of all income while those in the bottom 20 percent got less than 5 percent, the report said.

The analysis also found regional differences.

States in the South, such as Georgia and South Carolina, and those in the West, such as Arizona and Nevada, had the greatest increase in the number of working poor. The increase was slower in the Mid-Atlantic and Northeast.

"It's important to draw attention to the fact that there are real families behind those statistics," said Alan Essig, who heads the Georgia Budget and Policy Institute, adding that his state is still struggling with housing and unemployment.

And the Washington Post adds:

The growth in the ranks of the working poor coincides with continued growth in income inequality. Many of the occupations experiencing the fastest job growth during the recovery also pay poorly. Among them are retail jobs, food preparation, clerical work and customer assistance.

If Our Schools Are So Bad, Why Are They Teaching This Stuff?

I need my hope for the future restored in a big way. It's gone. I want to pack up my family and take them to another country. Shit, another world, another reality. Everything about this country is corrupt and it only gets worse, and if you stand up for your rights, or stand up for reform, the government and its corporate rulers have seen to it that they will crush you. Education reform is a joke.

The Hollow Reform Movement

by DAVID MACARAY

By now, thankfully, most people have come to the realization that the so-called “reform movement,” nominally dedicated to improving America’s public schools, is as bogus, misleading, and greed-driven as those tricked-out, bundled-up, sub-prime mortgages that almost sank Wall Street, and required a nearly trillion-dollar bailout from taxpayers.

Make no mistake. This well-coordinated effort to debase our schools is being fueled by (1) Republican anti-union forces who want to bust the teachers’ union, (2) entrepreneurs who see privatization as a potential gold mine, and (3) education mandarins and “consultants” who make their living peddling the view that our schools are in crisis.

Of course, all three groups blame the teachers and the teachers’ union for the mess we’re in, which, besides being vicious and duplicitous, is tantamount to blaming doctors for America’s obesity epidemic. (“Hey, you’re a doctor, aren’t you?? Then do something about all these fat people!!”)

Another thing most people probably realize is that there is an almost one-to-one correlation between bad, rundown, low-employment, high-crime neighborhoods and bad, low-achieving schools. Even though that correlation is a fact, the purveyors of public education horror stories continue to ignore it, and try, instead, to blame the teachers, accusing them of incompetence and apathy. Why? Because blaming teachers is so much easier than addressing those knotty sociological or economic problems.

But something that most people may not realize is that the curriculum being taught in those distressed inner city schools (where the percentage of students in foster care can be as high as 35-percent) is the exact same curriculum being taught in those affluent, stable, high-achieving school districts. Moreover, both sets of students take the exact same standardized tests to determine proficiency.

I asked a teacher in the LAUSD (Los Angeles Unified School District), the second-largest school district in the U.S. (behind New York City), for some sample 5th grade math questions from the CST (California Standards Test). At the bottom of the page are five (5) actual math problems from that test.

Take a peek at them and ask yourself this question: If our schools used to be “good,” and are now “bad,” why do these math problems seem harder than the ones we had as 5th graders? I don’t know about you, but I wasn’t exposed to this material until the 7th grade. They’re also teaching the periodic table to inner-city 5th graders, which, I vividly recall, we didn’t learn until high school.

Another thing people may not realize is that the CST has no bearing on a student’s report card or whether he or she will be promoted to the next grade. You can bottom out on the CST and pay no price (hence the concern over a student’s incentive to do well on an “irrelevant” standardized test). The CST is used solely as a means of measuring overall proficiency….and, of course, as ammunition for attacks on public school teachers.

Here are those test questions. I did not include the most difficult problems because the most difficult ones used geometric figures, algebraic graphs, and truth tables, none of which, alas, I was able to format.

But if the material I did include is the kind of material 5th grade teachers expect students to know, then the standards of our “bad” schools are not only significantly higher than people realize, but the 5th grade today is significantly harder than it was when I was a kid, back in the days when our schools were “good.”

The Hollow Reform Movement

by DAVID MACARAY

By now, thankfully, most people have come to the realization that the so-called “reform movement,” nominally dedicated to improving America’s public schools, is as bogus, misleading, and greed-driven as those tricked-out, bundled-up, sub-prime mortgages that almost sank Wall Street, and required a nearly trillion-dollar bailout from taxpayers.

Make no mistake. This well-coordinated effort to debase our schools is being fueled by (1) Republican anti-union forces who want to bust the teachers’ union, (2) entrepreneurs who see privatization as a potential gold mine, and (3) education mandarins and “consultants” who make their living peddling the view that our schools are in crisis.

Of course, all three groups blame the teachers and the teachers’ union for the mess we’re in, which, besides being vicious and duplicitous, is tantamount to blaming doctors for America’s obesity epidemic. (“Hey, you’re a doctor, aren’t you?? Then do something about all these fat people!!”)

Another thing most people probably realize is that there is an almost one-to-one correlation between bad, rundown, low-employment, high-crime neighborhoods and bad, low-achieving schools. Even though that correlation is a fact, the purveyors of public education horror stories continue to ignore it, and try, instead, to blame the teachers, accusing them of incompetence and apathy. Why? Because blaming teachers is so much easier than addressing those knotty sociological or economic problems.

But something that most people may not realize is that the curriculum being taught in those distressed inner city schools (where the percentage of students in foster care can be as high as 35-percent) is the exact same curriculum being taught in those affluent, stable, high-achieving school districts. Moreover, both sets of students take the exact same standardized tests to determine proficiency.

I asked a teacher in the LAUSD (Los Angeles Unified School District), the second-largest school district in the U.S. (behind New York City), for some sample 5th grade math questions from the CST (California Standards Test). At the bottom of the page are five (5) actual math problems from that test.

Take a peek at them and ask yourself this question: If our schools used to be “good,” and are now “bad,” why do these math problems seem harder than the ones we had as 5th graders? I don’t know about you, but I wasn’t exposed to this material until the 7th grade. They’re also teaching the periodic table to inner-city 5th graders, which, I vividly recall, we didn’t learn until high school.

Another thing people may not realize is that the CST has no bearing on a student’s report card or whether he or she will be promoted to the next grade. You can bottom out on the CST and pay no price (hence the concern over a student’s incentive to do well on an “irrelevant” standardized test). The CST is used solely as a means of measuring overall proficiency….and, of course, as ammunition for attacks on public school teachers.

Here are those test questions. I did not include the most difficult problems because the most difficult ones used geometric figures, algebraic graphs, and truth tables, none of which, alas, I was able to format.

But if the material I did include is the kind of material 5th grade teachers expect students to know, then the standards of our “bad” schools are not only significantly higher than people realize, but the 5th grade today is significantly harder than it was when I was a kid, back in the days when our schools were “good.”

1. 15.12 ÷ 2.4 =

A. 0.513

B. 0.63

C. 5.13

D. 6.3

2. What value of p makes this equation true?

44×73 = 44×( p + 3)

A. 41

B. 47

C. 70

D. 73

3. c + 2.5

Which situation could be described by the expression above?

A. Lia jogged c miles yesterday, and 2.5 miles farther today.

B. Lia jogged c miles yesterday, and 2.5 miles fewer today.

C. Lia jogged 2.5 miles yesterday, and c miles fewer today.

D. Lia jogged 2.5 miles yesterday, and c times as far today.

4. What is the prime factorization of 36?

A. 2-squared ×3-squared

B. 2-squared ×3-cubed

C. 4×3-squared

D. 4×9

5. Javier bought 9 pounds of ground beef. He saved $8.37 by using a store coupon. How much did he save per pound of ground beef?

A. $0.89

B. $0.93

C. $1.08

D. $75.33

Answers: 1. D, 2. C, 3. A, 4. A, 5. B

Posted by

spiderlegs

Labels:

culture of poverty,

education reform,

privatizing education,

public education,

teachers,

TEACHERS UNIONS,

union busting

The Five-Step Process to FUCK the Middle Class Worker

Monday, January 14, 2013 by Common Dreams

by Paul Buchheit

It's so artfully done, and so diabolical, that one can picture secret seminars in subterranean Wall Street meeting rooms, guiding young business recruits in the proven process of taking an extra share of wealth from the middle class. Their presentation might unfold as follows:

So we're hanging on by the frazzled thread of debt that indentures us to the rich and makes it harder and harder to fight back against the theft of our middle-class wealth. As we struggle to support ourselves, the super-rich remain on the take, driving us ever closer to the status of most wealth-unequal country in the world.

by Paul Buchheit

It's so artfully done, and so diabolical, that one can picture secret seminars in subterranean Wall Street meeting rooms, guiding young business recruits in the proven process of taking an extra share of wealth from the middle class. Their presentation might unfold as follows:

1. Boost productivity while keeping worker wages flat.

The trend is unmistakable, and startling: productivity has continued unabated while wages have simply stopped growing. Improved technologies have reduced the need for workers while globalization has introduced the corporate world to cheap labor. In effect, the workers who built a productive America over a half-century stopped getting paid for their efforts.

Paul Krugman suggests that a "sharp increase in monopoly power" is another reason for the disparity. As John D. Rockefeller said, "Competition is a sin." That certainly is the rule of thumb in banking and agriculture and health insurance and cell phones. Yet despite the fact that low-wage jobs are increasingly defining the American labor market, apologists for our meager minimum wage claim an increase will worsen unemployment. So it remains at $7.25. A minimum wage linked to productivity would be $21.00 per hour.

2. Build up a financial industry that has no maximum wage.

This is where the money is. In 2007, before the financial crisis, a Harvard survey revealed that almost half of the school's seniors aspired to careers in finance. The industry's share of corporate profits grew from 16% in 1980 to an astonishing 45% in 2002.

And there's no limit to the earning potential. Hedge fund manager John Paulson conspired with Goldman Sachs in 2007 to bundle sure-to-fail subprime mortgages in attractive packages, with just enough time for Paulson to collect other people's money to bet against his personally designed financial instruments. He made $3.7 billion, enough to pay the salaries of 100,000 new teachers.

3. Keep accumulating wealth created by the financial industry.

Experienced schemers have undoubtedly observed that over the past 100 years the stock market has grown three times faster than the GDP. The richest quintile of Americans owns 93% of such non-home wealth.

In the last 25 years, only the richest 5% of Americans have increased their share of non-home wealth, by the impressive rate of almost 20 percent.

In just one year, the richest 20 Americans earned more from their investments than the entire U.S. education budget.

4. Tax yourself as little as possible.

The easiest and least productive way to make money - holding on to investments - is also taxed at the lowest rate. In addition to the capital gains benefit, tax ploys like carried interest, performance-related pay, stock options, and deferred compensation allow hedge fund managers and CEOs to pay less than low-income Americans, and possibly even nothing at all.

The richest 400 taxpayers doubled their income in just seven years while cutting their tax rates nearly in half. U.S. corporations can match that, doubling their profits and cutting their taxes by more than half in under ten years. The 1.3 million individuals in the richest 1% cut their federal tax burden from 34% to 23% in just 25 years.

5. Lend out your excess money to people who can no longer afford a middle-class lifestyle.

As stated by Thom Hartmann, "The 'Takers' own vast wealth, and loan it out at interest to everybody from students to governments.." Overall, Americans are burdened with over $11 trillion in consumer debt, including mortgages, student loans, and credit card liabilities.

Wealth has largely disappeared for the middle- and lower-income classes. More than $7 trillion has been lost in the decline of home prices since 2006. Young college graduates have an average of $27,200 in student loans, and the 21-35 age group has lost 68% of its median net worth since 1984, leaving each of them about $4,000. Median net worth for single black and Hispanic women is a little over $100.

So we're hanging on by the frazzled thread of debt that indentures us to the rich and makes it harder and harder to fight back against the theft of our middle-class wealth. As we struggle to support ourselves, the super-rich remain on the take, driving us ever closer to the status of most wealth-unequal country in the world.

Yet Another Housing Bubble on the Horizon

Those who do not learn from history are doomed to repeat it. The power structure of the United States is comprised solely of short-sighted, greedy cunts who don't have to suffer the failure they commit over and over. We, the people, do. Fuck them!

The "Qualified Mortgage" Rule

by MIKE WHITNEY

The US Consumer Financial Protection Bureau’s rule defining a “qualified mortgage”, which was announced on Thursday, creates vast new opportunities for the nation’s biggest banks to engage in predatory lending practices with impunity. While the corporate mainstream media describes the rule as an attempt to protect borrowers from the risky types of loans that caused the financial crisis, the opposite is true. The real purpose of the rule is to provide legal protection for the banks from homeowner lawsuits, and to lay the groundwork for more reckless lending that could inflate another housing bubble. In other words, the rule was designed to serve the interests of the banks and the banks alone. This is why bankers everywhere are celebrating the final draft. Take a look at this from Forbes:

The banks are happy because they got everything they wanted; blanket legal immunity for garbage mortgages they plan to offload onto US taxpayers, a green light to resume extending credit to high-risk borrowers, and a first-rate public relations campaign that makes the entire coup look like genuine consumer protection.

As one cheery bankster quipped, “This was the Superbowl of rules”.

Indeed. It’s a big victory for the banks, but a major defeat for consumers. And the aftershocks will be felt for years to come, because (as we said in an earlier article) housing sales are already above trend and prices are back to normal which means that the only way the banks can reduce their huge backlog of 5 million distressed homes (which will face foreclosure in the next few years) is by creating another housing bubble. And, as we all know, housing bubbles require lax lending standards so that people who are not really creditworthy, end up borrowing hundreds of thousands of dollars that they’ll never be able to repay. This is what the new rule is really all about; it provides new opportunities for predatory lending, but with one notable difference from before, that is, if the loan meets the pitiable standard of a qualified mortgage, then the losses from the defaulting loan will be paid by taxpayers. That’s why the bankers are celebrating.

So, ignore the PR-hype about the banning of “deceptive teaser rates” or “no documentation loans” or “protecting the consumer”. That’s just a smoke screen to confuse you. The meat and potatoes in this rule, is what it doesn’t say. Here’s a clip from the Wall Street Journal that sums it up perfectly:

Have you ever heard anything more ridiculous in your life?

Didn’t we just go through a massive housing implosion which sent the financial system and the real economy into a 4-year death spiral? And now the agency which is supposed to protect consumers from another similar catastrophe is allowing the banks to issue mortgages that will be guaranteed by the government to applicants who don’t have the wherewithal for a lousy 5 or 10 percent down payment (No “skin in the game”) and whose credit scores will not be used to help decide whether they’re capable of repaying the loan or not?

What sense does that make? Does CFPB Director Richard Cordray think that he’s protecting consumers from the ravages of predatory lending by abandoning traditional standards and criteria for issuing a mortgage? Is that it?

Or is Cordray just another “captured” regulator doing the banks’ bidding? (It was clear that Cordray was another malleable bank toady back in Oct 2012 when this issue first arose. See: “Consumer Protector Caves to the Banks“, CounterPunch)

The media is making a big deal about the “ability-to-repay” provision of the new rule which requires banks to see that borrowers have sufficient assets or income to pay back the loan. But, once again, it’s all fluff. Banks don’t operate on the “honor system”. They’re going to stretch the new QM rule as far as possible, fitting borrowers into loans that will certainly fail sometime in the future. The losses for those loans will then be passed on to taxpayers. This is the same scam that took place during the subprime mortgage crisis. The banks booked profits on all manner of junk loans to high-risk borrowers figuring that the losses would be shifted onto investor groups who purchased the (subprime) bonds in the secondary market. The same nightmare is about to unfold again, only this time the banks won’t get stuck with the tab. Here’s an excerpt from an article in the New York Times that explains:

Can you believe it? Even the business-friendly NYT is shocked that the CFPB is giving the banks legal immunity. (“Safe harbor”) Why? Why would the government agree to insure the activities of private industry (through Fannie and Freddie), especially when that industry has shown that it is loaded with crooks and criminals? This is corporate welfare at its worst and, unfortunately, it creates a powerful incentive for the banks to game the system and recklessly extend credit to anyone who can sit upright and sign a mortgage application.

Here’s more from the NYT:

Of course they do. That’s how they make their money, by creating toxic loans that are passed along to Uncle Sam. How else are the banks going to boost profits in an economy where unemployment is 7.8%, underemployment is tipping 14%, where wages are shrinking, and where the net wealth of the average American has plunged by a harrowing 40 percent in the last decade?

Business investment?

Don’t make me laugh. The only way the banks can survive is by attaching themselves parasitically to the US government and sucking for all they’re worth. Bad loans are simply the modus operandi, the means by which they extract fluid from their victim. Cordray and Co. appear to be only-too-eager to assist them in this task. Here’s more from the Times:

Okay, so now we’re getting down to brass tacks. The banks want the new rule to shield them from future losses that will naturally accrue when they start ripping people off again. Right? This is why they fought tooth-n-nail to keep Elizabeth Warren off the CFPB board, because they knew she wouldn’t play ball with them. So they turned to “rubber stamp” Cordray instead, who has performed admirably executing Wall Street’s latest big heist with the skillfulness of a paid assassin.

Way to go, Rich.

There’s one more tidbit in the new QM rule that’s worth noting, a provision that states that “loans would be deemed qualified mortgages if borrowers are spending no more than 43% of their pretax income on monthly debt payments.”

“43% pretax income”?

You gotta be kidding me. That means that borrowers can qualify even if they’ll have to fork over 50% or more of their weekly paycheck. How many of those loans are going to get repaid?

Not many, I’d wager. This bill is a joke. Cordray has set up taxpayers for some hefty losses just to ingratiate himself with the Wall Street Bank Mafia. It’s shocking.

Can you see what’s going on?

The banks don’t want to act like banks anymore. They don’t want to hold capital against the loans they issue, they don’t want to keep loans on their books, and they don’t want to pay the losses when the loans blow up. The just want to keep printing private money (credit), booking profits on that money (loans), and then dumping the red ink on Uncle Sam. That’s how the whole thing works.

The QM rule was designed to work hand in hand with the Fed’s $40 billion per month purchases of mortgage backed securities. (MBS) This is key to understanding what’s going on.

The Fed, in concert with the Obama administration and the big banks, has replicated the same conditions that existed just prior to the last big bubble. The Central Bank will play the same role as investors in the secondary market (from 2003 to 2007), that is, the Fed will buy up all the garbage MBS the banks can produce. All the banks have to do is to find mortgage applicants who meet the wretched “no down payment, no credit score” requirements of the CFPB, and then “Let ‘er rip.”

All the pieces are now in place for another humongous, economy-crushing housing bubble. This isn’t going to end well.

The "Qualified Mortgage" Rule

by MIKE WHITNEY

The US Consumer Financial Protection Bureau’s rule defining a “qualified mortgage”, which was announced on Thursday, creates vast new opportunities for the nation’s biggest banks to engage in predatory lending practices with impunity. While the corporate mainstream media describes the rule as an attempt to protect borrowers from the risky types of loans that caused the financial crisis, the opposite is true. The real purpose of the rule is to provide legal protection for the banks from homeowner lawsuits, and to lay the groundwork for more reckless lending that could inflate another housing bubble. In other words, the rule was designed to serve the interests of the banks and the banks alone. This is why bankers everywhere are celebrating the final draft. Take a look at this from Forbes:

“We applaud the Bureau for offering a legal safe harbor to lenders when they originate loans that meet the rigorous ‘qualified mortgage’ standards in the rule,” said Debra Still, chairman of the Mortgage Bankers Association, in a statement. “This approach should allow lenders to offer sustainable mortgage credit to a great number of qualified borrowers without having to risk unreasonable and overly punitive litigation and penalties.” (Could New Tighter Mortgage Rules Actually Ease Lending?” Forbes)

The banks are happy because they got everything they wanted; blanket legal immunity for garbage mortgages they plan to offload onto US taxpayers, a green light to resume extending credit to high-risk borrowers, and a first-rate public relations campaign that makes the entire coup look like genuine consumer protection.

As one cheery bankster quipped, “This was the Superbowl of rules”.

Indeed. It’s a big victory for the banks, but a major defeat for consumers. And the aftershocks will be felt for years to come, because (as we said in an earlier article) housing sales are already above trend and prices are back to normal which means that the only way the banks can reduce their huge backlog of 5 million distressed homes (which will face foreclosure in the next few years) is by creating another housing bubble. And, as we all know, housing bubbles require lax lending standards so that people who are not really creditworthy, end up borrowing hundreds of thousands of dollars that they’ll never be able to repay. This is what the new rule is really all about; it provides new opportunities for predatory lending, but with one notable difference from before, that is, if the loan meets the pitiable standard of a qualified mortgage, then the losses from the defaulting loan will be paid by taxpayers. That’s why the bankers are celebrating.

So, ignore the PR-hype about the banning of “deceptive teaser rates” or “no documentation loans” or “protecting the consumer”. That’s just a smoke screen to confuse you. The meat and potatoes in this rule, is what it doesn’t say. Here’s a clip from the Wall Street Journal that sums it up perfectly:

“Do qualified mortgages have a minimum down payment or credit score requirement?

No. Instead, the rules focus primarily on documenting a borrower’s ability to make monthly payments.” (“What the CFPB Measures Mean For Borrowers”, Wall Street Journal)

Have you ever heard anything more ridiculous in your life?

Didn’t we just go through a massive housing implosion which sent the financial system and the real economy into a 4-year death spiral? And now the agency which is supposed to protect consumers from another similar catastrophe is allowing the banks to issue mortgages that will be guaranteed by the government to applicants who don’t have the wherewithal for a lousy 5 or 10 percent down payment (No “skin in the game”) and whose credit scores will not be used to help decide whether they’re capable of repaying the loan or not?

What sense does that make? Does CFPB Director Richard Cordray think that he’s protecting consumers from the ravages of predatory lending by abandoning traditional standards and criteria for issuing a mortgage? Is that it?

Or is Cordray just another “captured” regulator doing the banks’ bidding? (It was clear that Cordray was another malleable bank toady back in Oct 2012 when this issue first arose. See: “Consumer Protector Caves to the Banks“, CounterPunch)

The media is making a big deal about the “ability-to-repay” provision of the new rule which requires banks to see that borrowers have sufficient assets or income to pay back the loan. But, once again, it’s all fluff. Banks don’t operate on the “honor system”. They’re going to stretch the new QM rule as far as possible, fitting borrowers into loans that will certainly fail sometime in the future. The losses for those loans will then be passed on to taxpayers. This is the same scam that took place during the subprime mortgage crisis. The banks booked profits on all manner of junk loans to high-risk borrowers figuring that the losses would be shifted onto investor groups who purchased the (subprime) bonds in the secondary market. The same nightmare is about to unfold again, only this time the banks won’t get stuck with the tab. Here’s an excerpt from an article in the New York Times that explains:

“As regulators complete new mortgage rules, banks are about to get a significant advantage: protection against homeowner lawsuits … some banking and housing specialists worry that borrowers are losing a critical safeguard. Industries rarely get broad protection from consumer lawsuits, and banks would seem unlikely candidates given the range of abuses revealed during the housing bust.” (“Banks Seek a Shield in Mortgage Rules”, New York Times)

Can you believe it? Even the business-friendly NYT is shocked that the CFPB is giving the banks legal immunity. (“Safe harbor”) Why? Why would the government agree to insure the activities of private industry (through Fannie and Freddie), especially when that industry has shown that it is loaded with crooks and criminals? This is corporate welfare at its worst and, unfortunately, it creates a powerful incentive for the banks to game the system and recklessly extend credit to anyone who can sit upright and sign a mortgage application.

Here’s more from the NYT:

“The Consumer Financial Protection Bureau, the fledgling agency that is shaping the rules, faces a crucial but difficult task. Banks are pressing for a strong version of the legal shield. They also want qualified mortgages to be available to a broad range of borrowers, not just those with pristine credit.”

Of course they do. That’s how they make their money, by creating toxic loans that are passed along to Uncle Sam. How else are the banks going to boost profits in an economy where unemployment is 7.8%, underemployment is tipping 14%, where wages are shrinking, and where the net wealth of the average American has plunged by a harrowing 40 percent in the last decade?

Business investment?

Don’t make me laugh. The only way the banks can survive is by attaching themselves parasitically to the US government and sucking for all they’re worth. Bad loans are simply the modus operandi, the means by which they extract fluid from their victim. Cordray and Co. appear to be only-too-eager to assist them in this task. Here’s more from the Times:

“Big financial institutions have faced an onslaught of litigation since the downturn, although mostly by the government, investors and other companies instead of borrowers. In February, five large mortgage banks reached a $26 billion settlement with government authorities that aimed, in part, to hold banks accountable for foreclosure abuses.”

Okay, so now we’re getting down to brass tacks. The banks want the new rule to shield them from future losses that will naturally accrue when they start ripping people off again. Right? This is why they fought tooth-n-nail to keep Elizabeth Warren off the CFPB board, because they knew she wouldn’t play ball with them. So they turned to “rubber stamp” Cordray instead, who has performed admirably executing Wall Street’s latest big heist with the skillfulness of a paid assassin.

Way to go, Rich.

There’s one more tidbit in the new QM rule that’s worth noting, a provision that states that “loans would be deemed qualified mortgages if borrowers are spending no more than 43% of their pretax income on monthly debt payments.”

“43% pretax income”?

You gotta be kidding me. That means that borrowers can qualify even if they’ll have to fork over 50% or more of their weekly paycheck. How many of those loans are going to get repaid?

Not many, I’d wager. This bill is a joke. Cordray has set up taxpayers for some hefty losses just to ingratiate himself with the Wall Street Bank Mafia. It’s shocking.

Can you see what’s going on?

The banks don’t want to act like banks anymore. They don’t want to hold capital against the loans they issue, they don’t want to keep loans on their books, and they don’t want to pay the losses when the loans blow up. The just want to keep printing private money (credit), booking profits on that money (loans), and then dumping the red ink on Uncle Sam. That’s how the whole thing works.

The QM rule was designed to work hand in hand with the Fed’s $40 billion per month purchases of mortgage backed securities. (MBS) This is key to understanding what’s going on.

The Fed, in concert with the Obama administration and the big banks, has replicated the same conditions that existed just prior to the last big bubble. The Central Bank will play the same role as investors in the secondary market (from 2003 to 2007), that is, the Fed will buy up all the garbage MBS the banks can produce. All the banks have to do is to find mortgage applicants who meet the wretched “no down payment, no credit score” requirements of the CFPB, and then “Let ‘er rip.”

All the pieces are now in place for another humongous, economy-crushing housing bubble. This isn’t going to end well.

Monday, January 14, 2013

Exit Geithner

The Modern Day Metternich

by DEAN BAKER

Treasury Secretary Timothy Geithner’s departure from the Obama Administration invites comparisons with Klemens von Metternich. Metternich was the foreign minister of the Austrian Empire who engineered the restoration of the old order and the suppression of democracy across Europe after the defeat of Napoleon. This was an impressive diplomatic feat given the popular contempt for Europe’s monarchical regimes. In the same vein, protecting Wall Street from the financial and economic havoc they brought upon themselves and the country was an enormous accomplishment.

Just to remind everyone, during his tenure as head of the New York Fed and then Treasury Secretary, most, if not all, of the major Wall Street banks would have collapsed if the government had not intervened to save them. This process began with the collapse of Bear Stearns, which was bought up by J.P. Morgan in a deal involving huge subsidies from the Fed. The collapse of Lehman Brothers, a second major investment bank, started a run on the three remaining investment banks that would have led to the collapse of Merrill Lynch, Morgan Stanley, and Goldman Sachs if the Fed, FDIC, and Treasury did not take extraordinary measures to save them.

Citigroup and Bank of America both needed emergency facilities established by the Fed and Treasury explicitly for their support, in addition to all the below-market loans they received from the government at the time. Without this massive government support, there can be no doubt that both of them would currently be operating under the supervision of a bankruptcy judge.

Of the six banks that dominate the U.S. banking system, only Wells Fargo and J.P. Morgan could have conceivably survived without hoards of cash rained down on them by the federal government. Even these two are question marks, since both helped themselves to trillions of dollars of below-market loans, in addition to indirectly benefiting from the bailout of the other banks that protected many of their assets.

Had it not been for Geithner and his sidekicks we would have been permanently rid of an incredibly bloated financial sector that haunts the economy like a horrible albatross. Along with the salvation of the Wall Street banks, Geithner also managed to restore their agenda of deficit reduction.

Even though the economy is still down more than 9 million+ jobs from its full employment level, none of the important people in Washington are talking about measures that would hasten job creation. Instead the focus is exclusively on deficit reduction, a process that is already slowing growth and putting even more people out of work. While lives that are being ruined today by the weak economy, Geithner helped create a policy agenda where the focus of debate is the budget projections for 2022.

These projections are hugely inaccurate. Furthermore the actual budget for 2022 is largely out of the control of the politicians currently in power, since the Congresses elected in 2016, 2018, 2020 and 2022, along with the presidents elected in 2016 and 2020, may have some different ideas. Nonetheless, the path laid out by Geithner’s team virtually ensures that these distant budget targets will serve as a distraction from doing anything to help the economy now.

There are two important points that should be quashed quickly in order to destroy any possible defense of Timothy Geithner. It is often asserted that we were lucky to escape a second Great Depression. This is nonsense.

The first Great Depression was not simply the result of bad decisions made in the initial financial crisis. It was the result of 10 years of failed policy. There is zero, nothing, nada that would have prevented the sort of massive stimulus provided by World War II from occurring in 1931 instead of 1941. We know how to recover from a financial collapse; the issue is simply political will.

This is demonstrated clearly by the case of Argentina, which had a full-fledged collapse in December of 2001. After three months of free fall, its economy stabilized in the second quarter of 2002. It came roaring back in the second half of the year and had made up all of the lost ground by the middle of 2003. Its economy continued to grow strongly until the 2009 when the world economic crisis brought it to a standstill. There is no reason to believe that our policymakers are less competent than those in Argentina; the threat of a second Great Depression was nonsense.

Finally the claim that we made money on the bailouts is equally absurd. We lent money at interest rates that were far below what the market would have demanded. Most of this money, plus interest, was paid back. However claiming that we therefore made a profit would be like saying the government could make a profit by issuing 30-year mortgages at 1.0 percent interest. Surely most of the loans would be repaid, with interest, but everyone would understand that this is an enormous subsidy to homeowners.

In short, the Geithner agenda was to allow the Wall Street banks to feed at the public trough until they were returned to their prior strength. Like Metternich, he largely succeeded. Of course democracy did eventually triumph in Europe. Let’s hope that it doesn’t take quite as long here.

by DEAN BAKER

Treasury Secretary Timothy Geithner’s departure from the Obama Administration invites comparisons with Klemens von Metternich. Metternich was the foreign minister of the Austrian Empire who engineered the restoration of the old order and the suppression of democracy across Europe after the defeat of Napoleon. This was an impressive diplomatic feat given the popular contempt for Europe’s monarchical regimes. In the same vein, protecting Wall Street from the financial and economic havoc they brought upon themselves and the country was an enormous accomplishment.

Just to remind everyone, during his tenure as head of the New York Fed and then Treasury Secretary, most, if not all, of the major Wall Street banks would have collapsed if the government had not intervened to save them. This process began with the collapse of Bear Stearns, which was bought up by J.P. Morgan in a deal involving huge subsidies from the Fed. The collapse of Lehman Brothers, a second major investment bank, started a run on the three remaining investment banks that would have led to the collapse of Merrill Lynch, Morgan Stanley, and Goldman Sachs if the Fed, FDIC, and Treasury did not take extraordinary measures to save them.

Citigroup and Bank of America both needed emergency facilities established by the Fed and Treasury explicitly for their support, in addition to all the below-market loans they received from the government at the time. Without this massive government support, there can be no doubt that both of them would currently be operating under the supervision of a bankruptcy judge.

Of the six banks that dominate the U.S. banking system, only Wells Fargo and J.P. Morgan could have conceivably survived without hoards of cash rained down on them by the federal government. Even these two are question marks, since both helped themselves to trillions of dollars of below-market loans, in addition to indirectly benefiting from the bailout of the other banks that protected many of their assets.

Had it not been for Geithner and his sidekicks we would have been permanently rid of an incredibly bloated financial sector that haunts the economy like a horrible albatross. Along with the salvation of the Wall Street banks, Geithner also managed to restore their agenda of deficit reduction.

Even though the economy is still down more than 9 million+ jobs from its full employment level, none of the important people in Washington are talking about measures that would hasten job creation. Instead the focus is exclusively on deficit reduction, a process that is already slowing growth and putting even more people out of work. While lives that are being ruined today by the weak economy, Geithner helped create a policy agenda where the focus of debate is the budget projections for 2022.

These projections are hugely inaccurate. Furthermore the actual budget for 2022 is largely out of the control of the politicians currently in power, since the Congresses elected in 2016, 2018, 2020 and 2022, along with the presidents elected in 2016 and 2020, may have some different ideas. Nonetheless, the path laid out by Geithner’s team virtually ensures that these distant budget targets will serve as a distraction from doing anything to help the economy now.

There are two important points that should be quashed quickly in order to destroy any possible defense of Timothy Geithner. It is often asserted that we were lucky to escape a second Great Depression. This is nonsense.

The first Great Depression was not simply the result of bad decisions made in the initial financial crisis. It was the result of 10 years of failed policy. There is zero, nothing, nada that would have prevented the sort of massive stimulus provided by World War II from occurring in 1931 instead of 1941. We know how to recover from a financial collapse; the issue is simply political will.

This is demonstrated clearly by the case of Argentina, which had a full-fledged collapse in December of 2001. After three months of free fall, its economy stabilized in the second quarter of 2002. It came roaring back in the second half of the year and had made up all of the lost ground by the middle of 2003. Its economy continued to grow strongly until the 2009 when the world economic crisis brought it to a standstill. There is no reason to believe that our policymakers are less competent than those in Argentina; the threat of a second Great Depression was nonsense.

Finally the claim that we made money on the bailouts is equally absurd. We lent money at interest rates that were far below what the market would have demanded. Most of this money, plus interest, was paid back. However claiming that we therefore made a profit would be like saying the government could make a profit by issuing 30-year mortgages at 1.0 percent interest. Surely most of the loans would be repaid, with interest, but everyone would understand that this is an enormous subsidy to homeowners.

In short, the Geithner agenda was to allow the Wall Street banks to feed at the public trough until they were returned to their prior strength. Like Metternich, he largely succeeded. Of course democracy did eventually triumph in Europe. Let’s hope that it doesn’t take quite as long here.

Posted by

spiderlegs

Labels:

Bank of America (BofA),

Bear Sterns,

Citigroup,

Goldman Sachs,

JP Morgan Chase,

Lehman Bros.,

Morgan Stanley,

New York Federal Reserve Bank,

US Treasury Secretary Timothy Geithner,

Wall Street,

Wells Fargo

The Inspiring Heroism of Aaron Swartz

Sunday, January 13, 2013 by The Guardian/UK

The internet freedom activist committed suicide on Friday at age 26, but his life was driven by courage and passion

by Glenn Greenwald

Aaron Swartz, the computer programmer and internet freedom activist, committed suicide on Friday in New York at the age of 26. As the incredibly moving remembrances from his friends such as Cory Doctorow and Larry Lessig attest, he was unquestionably brilliant but also - like most everyone - a complex human being plagued by demons and flaws. For many reasons, I don't believe in whitewashing someone's life or beatifying them upon death. But, to me, much of Swartz's tragically short life was filled with acts that are genuinely and, in the most literal and noble sense, heroic. I think that's really worth thinking about today.

At the age of 14, Swartz played a key role in developing the RSS software that is still widely used to enable people to manage what they read on the internet. As a teenager, he also played a vital role in the creation of Reddit, the wildly popular social networking news site. When Conde Nast purchased Reddit, Swartz received a substantial sum of money at a very young age. He became something of a legend in the internet and programming world before he was 18. His path to internet mogul status and the great riches it entails was clear, easy and virtually guaranteed: a path which so many other young internet entrepreneurs have found irresistible, monomaniacally devoting themselves to making more and more money long after they have more than they could ever hope to spend.

But rather obviously, Swartz had little interest in devoting his life to his own material enrichment, despite how easy it would have been for him. As Lessig wrote: "Aaron had literally done nothing in his life 'to make money' . . . Aaron was always and only working for (at least his conception of) the public good."

Specifically, he committed himself to the causes in which he so passionately believed: internet freedom, civil liberties, making information and knowledge as available as possible. Here he is in his May, 2012 keynote address at the Freedom To Connect conference discussing the role he played in stopping SOPA, the movie-industry-demanded legislation that would have vested the government with dangerous censorship powers over the internet.

Critically, Swartz didn't commit himself to these causes merely by talking about them or advocating for them. He repeatedly sacrificed his own interests, even his liberty, in order to defend these values and challenge and subvert the most powerful factions that were their enemies. That's what makes him, in my view, so consummately heroic.

In 2008, Swartz targeted Pacer, the online service that provides access to court documents for a per-page fee. What offended Swartz and others was that people were forced to pay for access to public court documents that were created at public expense. Along with a friend, Swartz created a program to download millions of those documents and then, as Doctorow wrote, "spent a small fortune fetching a titanic amount of data and putting it into the public domain." For that act of civil disobedience, he was investigated and harassed by the FBI, but never charged.

But in July 2011, Swartz was arrested for allegedly targeting JSTOR, the online publishing company that digitizes and distributes scholarly articles written by academics and then sells them, often at a high price, to subscribers. As Maria Bustillos detailed, none of the money goes to the actual writers (usually professors) who wrote the scholarly articles - they are usually not paid for writing them - but instead goes to the publishers.

This system offended Swartz (and many other free-data activists) for two reasons: it charged large fees for access to these articles but did not compensate the authors, and worse, it ensured that huge numbers of people are denied access to the scholarship produced by America's colleges and universities. The indictment filed against Swartz alleged that he used his access as a Harvard fellow to the JSTOR system to download millions of articles with the intent to distribute them online for free; when he was detected and his access was cut off, the indictment claims he then trespassed into an MIT computer-wiring closet in order to physically download the data directly onto his laptop.

Swartz never distributed any of these downloaded articles. He never intended to profit even a single penny from anything he did, and never did profit in any way. He had every right to download the articles as an authorized JSTOR user; at worst, he intended to violate the company's "terms of service" by making the articles available to the public. Once arrested, he returned all copies of everything he downloaded and vowed not to use them. JSTOR told federal prosecutors that it had no intent to see him prosecuted, though MIT remained ambiguous about its wishes.

But federal prosecutors ignored the wishes of the alleged "victims". Led by a federal prosecutor in Boston notorious for her overzealous prosecutions, the DOJ threw the book at him, charging Swartz with multiple felonies which carried a total sentence of several decades in prison and $1 million in fines.

Swartz's trial on these criminal charges was scheduled to begin in two months. He adamantly refused to plead guilty to a felony because he did not want to spend the rest of his life as a convicted felon with all the stigma and rights-denials that entails. The criminal proceedings, as Lessig put it, already put him in a predicament where "his wealth [was] bled dry, yet unable to appeal openly to us for the financial help he needed to fund his defense, at least without risking the ire of a district court judge."

To say that the DOJ's treatment of Swartz was excessive and vindictive is an extreme understatement. When I wrote about Swartz's plight last August, I wrote that he was "being prosecuted by the DOJ with obscene over-zealousness". Timothy Lee wrote the definitive article in 2011 explaining why, even if all the allegations in the indictment are true, the only real crime committed by Swartz was basic trespassing, for which people are punished, at most, with 30 days in jail and a $100 fine, about which Lee wrote: "That seems about right: if he's going to serve prison time, it should be measured in days rather than years."

Nobody knows for sure why federal prosecutors decided to pursue Swartz so vindictively, as though he had committed some sort of major crime that deserved many years in prison and financial ruin. Some theorized that the DOJ hated him for his serial activism and civil disobedience. Others speculated that, as Doctorow put it, "the feds were chasing down all the Cambridge hackers who had any connection to Bradley Manning in the hopes of turning one of them."

I believe it has more to do with what I told the New York Times' Noam Cohen for an article he wrote on Swartz's case. Swartz's activism, I argued, was waged as part of one of the most vigorously contested battles - namely, the war over how the internet is used and who controls the information that flows on it - and that was his real crime in the eyes of the US government: challenging its authority and those of corporate factions to maintain a stranglehold on that information. In that above-referenced speech on SOPA, Swartz discussed the grave dangers to internet freedom and free expression and assembly posed by the government's efforts to control the internet with expansive interpretations of copyright law and other weapons to limit access to information.

That's a major part of why I consider him heroic. He wasn't merely sacrificing himself for a cause. It was a cause of supreme importance to people and movements around the world - internet freedom - and he did it by knowingly confronting the most powerful state and corporate factions because he concluded that was the only way to achieve these ends.

Suicide is an incredibly complicated phenomenon. I didn't know Swartz nearly well enough even to form an opinion about what drove him to do this; I had a handful of exchanges with him online in which we said nice things about each other's work and I truly admired him. I'm sure even his closest friends and family are struggling to understand exactly what caused him to defy his will to live by taking his own life.

But, despite his public and very sad writings about battling depression, it only stands to reason that a looming criminal trial that could send him to prison for decades played some role in this; even if it didn't, this persecution by the DOJ is an outrage and an offense against all things decent, for the reasons Lessig wrote today:

"Here is where we need a better sense of justice, and shame. For the outrageousness in this story is not just Aaron. It is also the absurdity of the prosecutor's behavior. From the beginning, the government worked as hard as it could to characterize what Aaron did in the most extreme and absurd way. The 'property' Aaron had 'stolen', we were told, was worth 'millions of dollars' — with the hint, and then the suggestion, that his aim must have been to profit from his crime. But anyone who says that there is money to be made in a stash of ACADEMIC ARTICLES is either an idiot or a liar. It was clear what this was not, yet our government continued to push as if it had caught the 9/11 terrorists red-handed.

"A kid genius. A soul, a conscience, the source of a question I have asked myself a million times: What would Aaron think? That person is gone today, driven to the edge by what a decent society would only call bullying. I get wrong. But I also get proportionality. And if you don't get both, you don't deserve to have the power of the United States government behind you.

"For remember, we live in a world where the architects of the financial crisis regularly dine at the White House — and where even those brought to 'justice' never even have to admit any wrongdoing, let alone be labeled 'felons'."

Whatever else is true, Swartz was destroyed by a "justice" system that fully protects the most egregious criminals as long as they are members of or useful to the nation's most powerful factions, but punishes with incomparable mercilessness and harshness those who lack power and, most of all, those who challenge power.

Swartz knew all of this. But he forged ahead anyway. He could have easily opted for a life of great personal wealth, status, prestige and comfort. He chose instead to fight - selflessly, with conviction and purpose, and at great risk to himself - for noble causes to which he was passionately devoted. That, to me, isn't an example of heroism; it's the embodiment of it, its purest expression. It's the attribute our country has been most lacking.

I always found it genuinely inspiring to watch Swartz exude this courage and commitment at such a young age. His death had better prompt some serious examination of the DOJ's behavior - both in his case and its warped administration of justice generally. But his death will also hopefully strengthen the inspirational effects of thinking about and understanding the extraordinary acts he undertook in his short life.

UPDATE

From the official statement of Swartz's family:

"Aaron's death is not simply a personal tragedy. It is the product of a criminal justice system rife with intimidation and prosecutorial overreach. Decisions made by officials in the Massachusetts US Attorney's office and at MIT contributed to his death. The US Attorney's office pursued an exceptionally harsh array of charges, carrying potentially over 30 years in prison, to punish an alleged crime that had no victims. Meanwhile, unlike JSTOR, MIT refused to stand up for Aaron and its own community's most cherished principles."

This sort of unrestrained prosecutorial abuse is, unfortunately, far from uncommon. It usually destroys people without attention or notice. Let's hope - and work to ensure that - the attention generated by Swartz's case prompts some movement toward accountability and reform.

The four business gangs that run the US

Ross Gittins

The Sydney Morning Herald's Economics Editor

IF YOU'VE ever suspected politics is increasingly being run in the interests of big business, I have news: Jeffrey Sachs, a highly respected economist from Columbia University, agrees with you - at least in respect of the United States.

In his book, The Price of Civilisation, he says the US economy is caught in a feedback loop. ''Corporate wealth translates into political power through campaign financing, corporate lobbying and the revolving door of jobs between government and industry; and political power translates into further wealth through tax cuts, deregulation and sweetheart contracts between government and industry. Wealth begets power, and power begets wealth,'' he says.

Sachs says four key sectors of US business exemplify this feedback loop and the takeover of political power in America by the ''corporatocracy''.

First is the well-known corporate military-industrial complex. ''As [President] Eisenhower famously warned in his farewell address in January 1961, the linkage of the military and private industry created a political power so pervasive that America has been condemned to militarisation, useless wars and fiscal waste on a scale of many tens of trillions of dollars since then,'' he says.

Second is the Wall Street-Washington complex, which has steered the financial system towards control by a few politically powerful Wall Street firms, notably Goldman Sachs, JPMorgan Chase, Citigroup, Morgan Stanley and a handful of other financial firms.

These days, almost every US Treasury secretary - Republican or Democrat - comes from Wall Street and goes back there when his term ends. The close ties between Wall Street and Washington ''paved the way for the 2008 financial crisis and the mega-bailouts that followed, through reckless deregulation followed by an almost complete lack of oversight by government''.

Third is the Big Oil-transport-military complex, which has put the US on the trajectory of heavy oil-imports dependence and a deepening military trap in the Middle East, he says.

''Since the days of John D. Rockefeller and the Standard Oil Trust a century ago, Big Oil has loomed large in American politics and foreign policy. Big Oil teamed up with the automobile industry to steer America away from mass transit and towards gas-guzzling vehicles driving on a nationally financed highway system.''

Big Oil has consistently and successfully fought the intrusion of competition from non-oil energy sources, including nuclear, wind and solar power.

It has been at the side of the Pentagon in making sure that America defends the sea-lanes to the Persian Gulf, in effect ensuring a $US100 billion-plus annual subsidy for a fuel that is otherwise dangerous for national security, Sachs says.

''And Big Oil has played a notorious role in the fight to keep climate change off the US agenda. Exxon-Mobil, Koch Industries and others in the sector have underwritten a generation of anti-scientific propaganda to confuse the American people.''

Fourth is the healthcare industry, America's largest industry, absorbing no less than 17 per cent of US gross domestic product.

''The key to understanding this sector is to note that the government partners with industry to reimburse costs with little systematic oversight and control,'' Sachs says. ''Pharmaceutical firms set sky-high prices protected by patent rights; Medicare [for the aged] and Medicaid [for the poor] and private insurers reimburse doctors and hospitals on a cost-plus basis; and the American Medical Association restricts the supply of new doctors through the control of placements at medical schools.

''The result of this pseudo-market system is sky-high costs, large profits for the private healthcare sector, and no political will to reform.''

Now do you see why the industry put so much effort into persuading America's punters that Obamacare was rank socialism? They didn't succeed in blocking it, but the compromised program doesn't do enough to stop the US being the last rich country in the world without universal healthcare.

It's worth noting that, despite its front-running cost, America's healthcare system doesn't leave Americans with particularly good health - not as good as ours, for instance. This conundrum is easily explained: America has the highest-paid doctors.

Sachs says the main thing to remember about the corporatocracy is that it looks after its own. ''There is absolutely no economic crisis in corporate America.

''Consider the pulse of the corporate sector as opposed to the pulse of the employees working in it: corporate profits in 2010 were at an all-time high, chief executive salaries in 2010 rebounded strongly from the financial crisis, Wall Street compensation in 2010 was at an all-time high, several Wall Street firms paid civil penalties for financial abuses, but no senior banker faced any criminal charges, and there were no adverse regulatory measures that would lead to a loss of profits in finance, health care, military supplies and energy,'' he says.

The 30-year achievement of the corporatocracy has been the creation of America's rich and super-rich classes, he says. And we can now see their tools of trade.

''It began with globalisation, which pushed up capital income while pushing down wages. These changes were magnified by the tax cuts at the top, which left more take-home pay and the ability to accumulate greater wealth through higher net-of-tax returns to saving.''

Chief executives then helped themselves to their own slice of the corporate sector ownership through outlandish awards of stock options by friendly and often handpicked compensation committees, while the Securities and Exchange Commission looked the other way. It's not all that hard to do when both political parties are standing in line to do your bidding, Sachs concludes.

Fortunately, things aren't nearly so bad in Australia. But it will require vigilance to stop them sliding further in that direction.

The Sydney Morning Herald's Economics Editor

IF YOU'VE ever suspected politics is increasingly being run in the interests of big business, I have news: Jeffrey Sachs, a highly respected economist from Columbia University, agrees with you - at least in respect of the United States.

In his book, The Price of Civilisation, he says the US economy is caught in a feedback loop. ''Corporate wealth translates into political power through campaign financing, corporate lobbying and the revolving door of jobs between government and industry; and political power translates into further wealth through tax cuts, deregulation and sweetheart contracts between government and industry. Wealth begets power, and power begets wealth,'' he says.

Sachs says four key sectors of US business exemplify this feedback loop and the takeover of political power in America by the ''corporatocracy''.

First is the well-known corporate military-industrial complex. ''As [President] Eisenhower famously warned in his farewell address in January 1961, the linkage of the military and private industry created a political power so pervasive that America has been condemned to militarisation, useless wars and fiscal waste on a scale of many tens of trillions of dollars since then,'' he says.

Second is the Wall Street-Washington complex, which has steered the financial system towards control by a few politically powerful Wall Street firms, notably Goldman Sachs, JPMorgan Chase, Citigroup, Morgan Stanley and a handful of other financial firms.

These days, almost every US Treasury secretary - Republican or Democrat - comes from Wall Street and goes back there when his term ends. The close ties between Wall Street and Washington ''paved the way for the 2008 financial crisis and the mega-bailouts that followed, through reckless deregulation followed by an almost complete lack of oversight by government''.

Third is the Big Oil-transport-military complex, which has put the US on the trajectory of heavy oil-imports dependence and a deepening military trap in the Middle East, he says.

''Since the days of John D. Rockefeller and the Standard Oil Trust a century ago, Big Oil has loomed large in American politics and foreign policy. Big Oil teamed up with the automobile industry to steer America away from mass transit and towards gas-guzzling vehicles driving on a nationally financed highway system.''

Big Oil has consistently and successfully fought the intrusion of competition from non-oil energy sources, including nuclear, wind and solar power.

It has been at the side of the Pentagon in making sure that America defends the sea-lanes to the Persian Gulf, in effect ensuring a $US100 billion-plus annual subsidy for a fuel that is otherwise dangerous for national security, Sachs says.